Bitcoin Flips Amazon Again, Reclaiming Spot as World’s Fifth-Largest Asset

Bitcoin is once again looking down on Amazon in the global asset rankings. The world’s leading cryptocurrency is now the fifth-largest tradable asset by market capitalization, narrowly edging out the e-commerce and cloud computing behemoth in a volatile, neck-and-neck race.

In Brief

Recurring Battle: This marks another chapter in the ongoing rivalry for the spot, as Bitcoin had also briefly overtaken the e-commerce giant back in May.

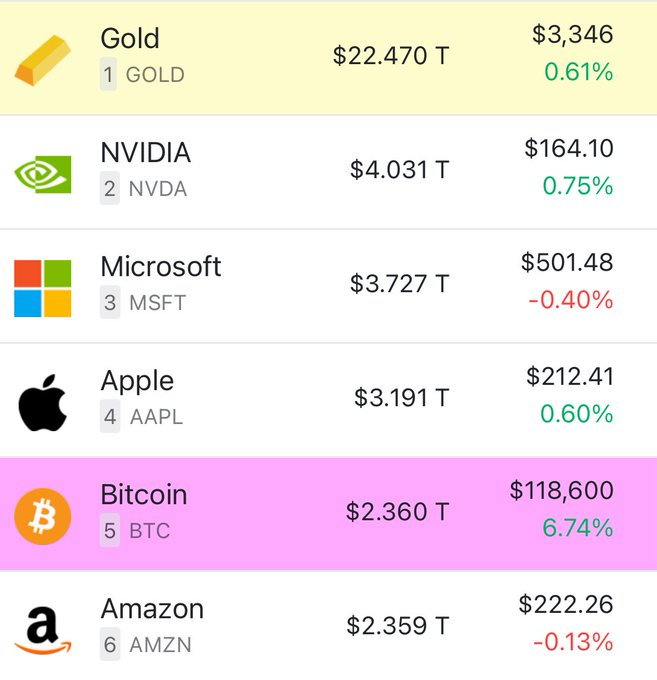

Bitcoin Moves to #5: Bitcoin’s market capitalization has surged to $2.36 trillion, pushing it past Amazon to become the fifth-largest asset in the world by market value.

A Narrow Lead: The move was driven by a significant daily price increase, giving Bitcoin a razor-thin lead over Amazon’s $2.359 trillion market cap, according to data from 8marketcap.

The move came as Bitcoin posted a strong daily gain of over 6.7%, pushing its price to $118,600 and its total market value to $2.36 trillion. That was just enough to leapfrog Amazon, which sat at a market cap of $2.359 trillion. The data, tracked on CoinMarketCap, highlights the digital asset’s growing influence in mainstream finance.

A Familiar Battleground for Fifth Place

For market watchers, this is a familiar scene. This isn’t the first time the digital asset has seized the spot from its tech rival.

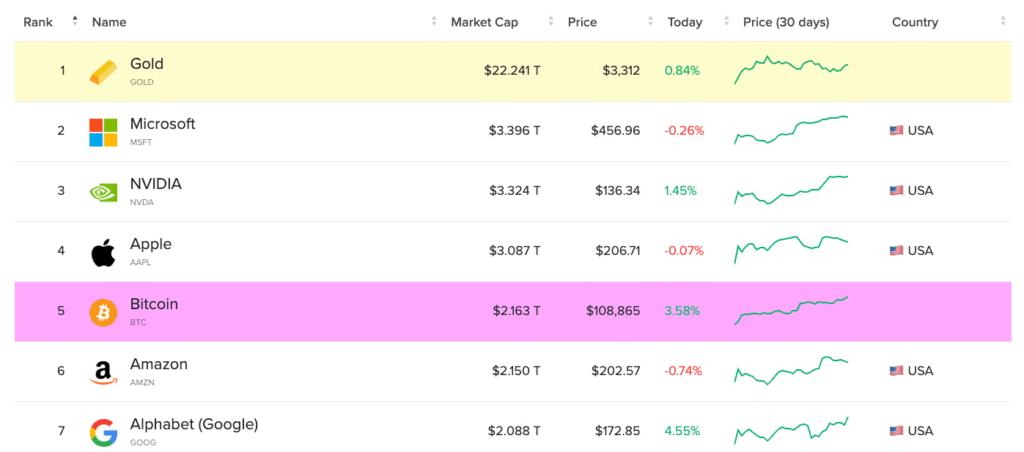

Back in May, Bitcoin experienced a similar surge that briefly pushed its market cap to $2.16 trillion, surpassing Amazon’s at the time. The latest flip underscores the ongoing battle for dominance and the increasing correlation of Bitcoin’s valuation with the world’s largest companies.

While Bitcoin has shown remarkable year-to-date performance, Amazon’s stock has seen a more sluggish period. This divergence in performance has created the conditions for these frequent re-shufflings in the top-ten asset list.

Tailwinds from Politics and Bitcoin ETFs

The recent rally has been fueled by several powerful factors. Much of the positive momentum is attributed to a favorable political climate since the election of President Donald Trump, which has been perceived as pro-crypto by the market.

Beyond political sentiment, a relentless river of institutional money has been flowing into the asset, largely through spot Bitcoin ETFs. According to data from Bloomberg, BlackRock’s iShares Bitcoin Trust (IBIT) alone has seen roughly $9 billion in inflows this year, making it one of the most successful ETF launches in history. This sustained institutional buying pressure provides a strong support floor for Bitcoin’s price.

While surpassing Amazon marks a major milestone, Bitcoin still has a steep climb ahead to catch the next giants on the list. It’s still trailing behind Apple ($3.191T), Microsoft ($3.727T), and NVIDIA ($4.031T). And towering over them all is Gold, holding its throne with a massive market cap of over $22 trillion.

Interesting read! Understanding patterns is key in baccarat, and a solid platform helps. I’ve been checking out ph11 link – seems legit with easy registration, which is a big plus for new players! Good insights here.

Trying to land some big wins at xx88win! Website looks clean, and the signup process was a breeze. Let’s see if I can break the bank! xx88win

Sup everyone! Gave 76n a go the other night. The layout is clean and easy to use, which is always a plus. Game selection is decent too. Worth a quick peek at 76n.

mwplay88 is my go-to for a quick game! The interface is user-friendly, and I’ve already had a few small wins. Give it a try! Check it out: mwplay88

Right, let’s talk fuwinplataforma. Kinda new to this but this platform has a clean design! I’m still learning about it. Worth exploring though! Here’s fuwinplataforma to check out.

Alright cobbers, cashhoardslot just gave me a big score. The interface is clean, too. Cheers m8! cashhoardslot

Logging in to 161betlogin is super easy, which is a plus. I found the games quickly! Their mobile app is solid, too. So far so good!